Lower Premiums on Property Insurance: A Path to Financial Relief and Security

Importance of property insuranceis an essential aspect of financial planning that protects you from unexpected events like theft, natural disasters, or accidents. The cost of premiums has now become a huge burden on homeowners and businesses. Reducing premiums on property insurance can be a much-needed financial relief for those affected while ensuring they also have adequate protection in place to maintain their livelihood and property. In this article, we will discuss how lower premiums benefit you, ways to get lower premiums and how that affects policyholders and the insurance industry.

1.Lower Premiums are Beneficial

Reducing property insurance premiums dramatically affects household budgets and the way businesses are run. Lower premiums for homeowners result in higher disposable income that can then set aside for other necessary matters, whether it be education, healthcare, or savings. For businesses, reduced insurance costs can help cash flow and allow reinvestment into growth initiatives or employee benefits. Moreover, competitive rates allow a larger segment of the population to afford coverage, resulting in fewer uninsured assets and increased financial stability overall.

2.Strategies to Lower Premiums

Insurers typically use risk level of a property to establish premiums. For example, policyholders can demonstrate to their insurer that risk has been mitigated if risk mitigation measures like security systems, fire alarms, and storm-resistant features have been implemented — possibly qualifying them for a lower premium. The upkeep and improving the quality of the property must be maintained and can foster a safer premise, which, in turn, is another factor that can keep insurance costs low.

Bundling Policies: Insurers often offer discounts if you bundle multiple policies with them, such as home and auto insurance. This streamlines the insurance process as well as saving substantial amounts on premiums. To get the most bang for the buck, policyholders should inquire about bundling with their insurers.

Raise Your Deductibles: Increasing the deductible, the sum the insured person must pay out of pocket before insurance coverage becomes active, can result in decreased premiums. This route, while generally more sound than merely denying the expense, simply requires you to weigh your ability to absorb sudden out-of-pocket costs against the ongoing cost savings insurance benefits can provide.

Shopping Around: The insurance market is very competitive, and prices can vary widely among providers. Policyholders should repeatedly compare quotes from other insurers toensure they get the very best rates. Using online comparison tools and independent insurance agents can help make this process easier.

Discounts and Benefits of Loyalty: Some insurers offer discounts if you've been with them for a long time, or if you've made few or no claims. Policyholders should ask about such perks and use their loyalty to haggle for better rates.

Property-specific Insurance: If a property owner makes a significant investment in safety features, some insurers may offer discounts on premiums. These programs could lower premiums while strengthening community resilience.

3.Wider Implications for theInsurance Industry

It is not only good for policyholders but also creates range for the insurance industry to further take benefits of it. Indeed, if insurers can help make insurance more manageable, they can increase their customer reach whilst decreasing the volume of uninsured or underinsured properties. That ultimately reduces the cost burden on governments and communities during disasters. But insurers need to balance affordability and sustainability. Lower premiums should never involve sacrificing coverage or the viability of insurers. By offering cost-effective solutions, through preventing measures or technology-based risk assessment, insurers can maintain profitability with innovative approaches.

In summary, declining rates on property insurance are a win-win for policyholders and insurers both. They bring stability to the insurance marketplace, as they provide financial support to homeowners and businesses, promote wider access to insurance, and incentivize mitigation and risk management. Incorporating risk mitigation, policy bundling, and frequent market comparisons can lead to impressive savings for both individuals and companies. With many new entrants offering competitive rates, the insurance industry faces a challenge in building customer loyalty as well. This creates a society that is safer and more resilient, allowing property owners to insure their assets while also ensuring that it fits their financial needs.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Finance

FinanceAdvantages of Fixed Income Funds

Fixed income funds have long been an integral part of investment portfolios, particularly due to the diverse range of benefits they provide to both conservative and strategic investors. These funds usually invest in debt securities, including government and corporate bonds and other fixed-income securities, and offer a regular stream of income from their interest payments. Here, we delve more into the benefits of fixed income funds and why they continue to be a favorite among investments seeking stability, diversification, and predictable returns.1.Steady and Predictable IncomeFixed income funds have one of the major advantages that can both generate a consistent and predictable income. Unlike volatile and uncertain investing in equities with progressive returns,fixed income funds pay regular interest. This makes them especially appealing for retirees or investors who need a steady income stream to meet their financial commitments. Returns being predicted make it easier for investors to plan their finances more confidently.2.Less Risky Than Equity FundsUnlike stocks, where the return in volatile, bonds and other debt instruments aretypically less volatile because the return is not directly correlated to the performance to the issuing company. The repayment of bondholders takes priority over dividends to shareholders, even if a company is performing poorly. Government bonds in particular are regarded as a safe haven because of the low chance of default. Such lower risk profile makes fixed income funds a perfect fit for risk-averse investors.3.Portfolio DiversificationFixed income funds are fundamental in diversifying portfolios, one of the principles of prudent investing. Adding fixed income funds toa portfolio can help lower overall risk and volatility. Bonds also tend to have a low or negative correlation with equities so they tend to do well when stock markets underperform. This inverse correlation tends to act as portfolio hedge, offering stability when the market experiences decline, and aiding in long-term prudence.4.Capital PreservationFixed income funds are perfect for the capital preserver investor. If they don't have the earnings potential of equities, they are less likely to lose a lot of money. This is critical for retirees or anyone with financial goals in the near term, as this strategy protects their principal investment from being substantially depleted. Government (particularly U.S. Federal) and other high-qualitycorporate bonds, for example, have traditionally offered a safe haven for capital while still yielding modest returns.5.LiquidityThe liquidity profile in fixed income funds is much higher than single bonds. Although individual bonds can be hard to sell before their maturity date, fixed income funds enable investors to buy and sell shares on any business day. This liquidity offers flexibility, allowing investors to withdraw their funds at a pinch, without facing heavy early withdrawal charges or losses. This facility alsomakes it easier to re-balance portfolios based on changing market scenarios or personal financial requirements.6.Professional ManagementFixed income funds offer professional management, a factor that can be vital in the bond marketlabyrinth. The same goes for flexible debt fund, the fund manager is someone who will analyze credit risk, interest rate cycle and economic conditions, to get the fund's portfolio where it lays out tobe. This professional focus might help avoid bad betsand potentially lead to stronger returns than the same capital would generate if invested in one bond at a time, potentially threatening an individual bond investment.Despite this, fixed income funds provide an attractive balance of consistent income, lower risk, diversification,and capital preservation, making them a necessary part of a diversified investment portfolio. With their stability, professional management and liquidity, they can suit almost any type of investor — stability seekers as well as risk diversification for those with riskier holdings. Not offering as lofty returns as equities, their contributions to dampening portfolio volatility and ensuring financial peace of mind is obvious. However, for conservative investors looking for an asset class that has stood the test of time, fixed income funds have been a tried and true investment vehicle. -

Finance

FinanceTypes of Loans: A Comprehensive Guide

Loansmust be the mainstay of personal and business finance, helping individuals and organizations fulfill their aspirations. Loans allow access to money when needed — whether it be for a new home, funding a business, or handling surprise expenses — that can be paid back in installments. But not all loans are created equal.The future financial decision we will make is based on the type of loan we can take. This article covers the different types of loans, their purposes, and theirmain characteristics.1.Personal LoansIn a personal loan, borrowers receive a lump sum of funds to return in fixed monthly payments over a set period of time, often one to seven years.The interest rates for personal loans can vary greatly on the credit rating, income, and repayment record of the borrowing individual.Personal loans provide flexibility but tend to carry higher interest rates than secured loans.2.Mortgage LoansMortgage loanisa type of loan that is used specifically to purchase real estate (i.e. to buy a home or a property), as opposed to personal loans. These are secured loans, meaning that the property in question is used as collateral. Because mortgages can represent an, if not the, largest monthly financial obligation anyone assumes, borrowers should study their budget andlong-term plans carefully before signing on the dotted line.3.Auto LoansAuto loans are loans for the purchase of a new or used vehicle. Auto loans are also secured, just like mortgages, using the automobile as collateral. If the borrower does not make payments, the lender can take back the car. Auto loans usually have shorter repayment periods, anywherefrom three to seven years, and they come with competitive interest rates. The loan amount is usually based on the price of the vehicle, the borrower's creditworthiness and the down payment. Autoloans area common option for those who require reliable transportation but cannot afford to purchase a vehicle upfront.4.Student LoansHigher education is often expensive and it is the purpose of student loans to assist individuals finance their college costs for tuition, books and those bit more expensive living expenses. These loans may come from the government or private lenders. Federal student loans tend to offer lower interest rates and more flexible repayment options than private loans, such as income-driven repayment plans, graduated repayment plans, and possible loan forgiveness.Private student loans, by contrast, can carry a higher interest rate and far fewer protective provisions for borrowers. Student loans are unique because they usually do not need to be repaid until after the borrower has graduated or dropped out, making them an easy option for many students.5.Payday LoansThey are known as payday loan and are high interest loan designed to be paid back with a borrowers next paycheck. These loans are usually for small amounts and intended to cover emergency costs. Payday loans, as previously mentioned, have astronomically high interest rates and fees, meaning they can be a dangerous choice for those borrowing money. Many financial experts recommend payday loans only if there are no other options, because they can start a cycle of debt if not paid back immediately.Borrowings are financial weapons that can work for or against you but come at a cost.Each of this type serves a unique purpose and has its own associated terms, interest rates, and risk-sustainability. Before borrowing, it's important to evaluate your financial essential, shop around and have an understanding of the long-term ramifications of taking out a loan. That will help you to create informed decisions based on your needs and to have a secure financial future.From buying a home to funding an education to starting a business, the right loan can be an important steppingstone toward success. -

Home & Garden

Home & GardenPatio Furniture to Invigorate Your Outdoor Activities

It can be understood that the transformation of your outside area into a bright, practical, and welcoming spot can improve the quality of outdoor activities you perform there.No matter for outdoor barbecue in summer, morning coffee or sunlight bath, patio furniture can meet all your desires and standards. From chairs to tables to hammocks, patio furniture is not just about the attraction for eyes, it can also offer you comfortable and durable outdoor activities.1.Comfort Meets StyleComfortable seating is the foundation for any great outdoor space. From cushy lounge chairs to comfy sectionals, patio furniture is made for supreme comfort all while matching your outdoor decor. Weather-resistant fabrics will create a more comfortable atmosphere on cushioned chairs and sofas. Throw pillows are a good way to add some color and warmth to your setup. For those who enjoy entertaining at home, modular seating arrangements are a great way to tailor your setup for entertaining groups, no matter how big or small.2.Sturdy Dining SetDining outdoors is a classic to patio enjoyment. A strong dining set with a big table and chair helps to convert your backyard into the ideal location for family meals or get-togethers with buddies. Seek materials like teak, aluminum or polywood, which are durable and resistant to the elements. You may also include umbrellas or pergolas to shade the area so you can dine comfortably even on sunny days.3.Lounge and UnwindIf you want to have a place to lie down, you can add a lying chair or hammock which are suitable for reading, sleeping or just enjoying the good fresh air outdoors. Pair them with a sidetable, where your drinks, books and snacks will go, to achieve seamless functionality and relaxation. If you have room, a daybedor swing chair can make your outdoor retreat feel luxurious.This kind of living style is so magical and can make a great difference in your life, thanks to the patio furniture you choose right according to this suggestion.4.Fire Pits and WarmthFirepits or outdoor heaters can extend the use of your patio into the cooler evening hours. Later, circle your fire pit with comfy seating for roasting marshmallows or trading stories under the stars. Fire pits come in all kinds of styles, everything from a rough-hewn stone design to a polished metal option so you can find one that suits your aesthetic.5.Durability and MaintenanceWhen choosing patio furniture, research your climate and how much maintenance you’re willing to do. Wrought iron and aluminum are rust proof, making them suitable for humid or coastal environments; teak and cedar provide a natural aesthetic and resilience with little maintenance. If you want a low-maintenance alternative, synthetic options such as polywood are environmentally friendly and durable.6.Personalize Your OasisYour patio should be an extension of your personality and lifestyle. From a minimalist modern aesthetic to a bohemian, eclectic vibe, there’s patio furniture for every style palate. Pick and choose pieces to form a space that feels like an extension of your indoor living space. Add things like water features, outdoor art and a bar cart to make your patio feel even more inviting.”Together with the right patio furniture, you can design an outdoor sanctuary that motivates you to head outside, entertain and get close to nature. With a little thought to comfort, style and functionality, you can design a patio that serves your needs and makes you want to spend more time outside. From hosting a raucous gathering or simply finding some quiet moments alone, the right type of patio furniture will give you the inspiration to enliven outdoor activities and make every moment count, not just during the summer months.

Featured Articles

-

Home & Garden

Home & GardenUltimate Guide to Choosing a Washer and Dryer

-

Finance

FinanceAdvantages of Fixed Income Funds

-

Travel

TravelTaking a Mississippi River Cruise: An Unforgettable Experience

-

Automotive

AutomotiveTips to Know Before Buying a Car

-

Automotive

AutomotiveReasons Why Costco Tires Are Your Optimum Selections

-

Automotive

AutomotiveWhy We Turn to Firestone for Auto Care

-

Home & Garden

Home & GardenBenefits of Wooden Flooring: Why Every Family Loves It

-

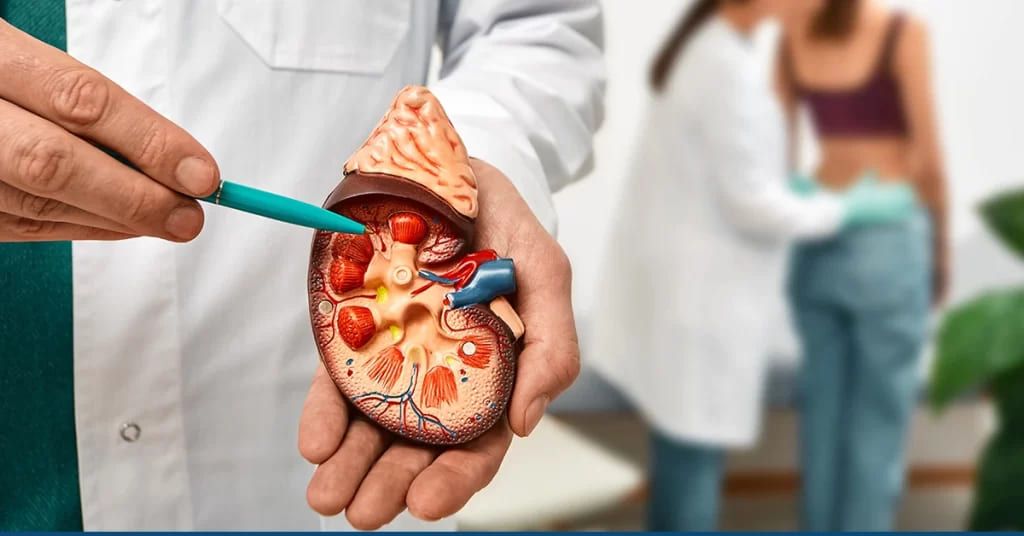

Health & Wellness

Health & WellnessReasons of the Appearance of the of Kidney Stones