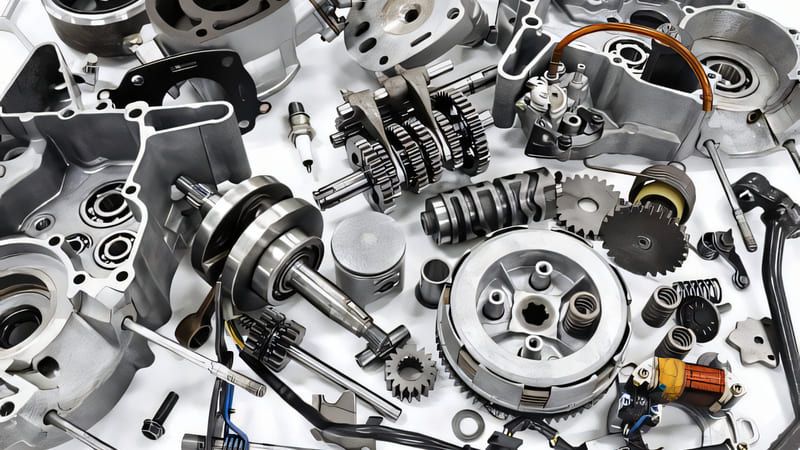

Finding Cheap Motorcycle Components on eBay

In theworld of motorcycle maintenance and customization, discovering low-cost anddurable components is anever-ending struggle. The cost of parts can add up with years of riding experience, novice or pro. Fortunately, eBay has become a favorite place to find inexpensive motorcycleparts at quality items. From large inventories tocompetitive pricing and a user-friendly interface, eBay provides one-of-a-kind options formotorcycleenthusiasts to get theirbike in order without breaking the bank.

Why eBay?

eBay is the world's largest online marketplace where theworld comes to buy and sell. In the world of motorcycle parts and accessories, that really translates to everything from simple replacement elements like brake pads, chains, and filters, to upgrades and accessories like exhaust systems, handlebars, and custom fairing. The auction-style listings and “Buy It Now” options features enable users to search for deals that work for its budget. Plus, eBay has buyer protection policies, so purchases are safe andshopping is guilt-free.

Best Tips

1.Use Specific Search Terms

Search to do so with specific keywords to narrow down your results and obtain the best prices. Run searches for “Yamaha MT-07 brake caliper” or “Honda CBR600RR exhaust system” instead of “motorcycle parts,” for example. Add your motorcycle’s make, model, and year to help you narrow down compatible parts fast.

2.Check Seller Backgrounds and Reviews

eBay grading system enables buyers to gradethe sellers based on the value of their transactions. Find sellers with feedback that is 95% positive or better. This minimizes the likelihood that you get low-quality or counterfeit components.

3.Compare Prices

One of the benefits of eBay is that you can compare prices between different sellers. So scroll through listings before you book to verify that you’re getting the best deal. Consider shipping prices, as some sellers provide free or reduced shipping.

4.Look forUsed or Refurbished Parts

And if you find yourselfon a tight budget, buy used or refurbished components. There are hundreds of sellers on the website willing to sell second-hand spare parts in perfect condition. Just make sure that you read the item description closely, and look for any signs of wear or damage.

5.Take Advantage of Auctions

The auction featureon eBay can be a goldmine for bargain hunters. By bidding on items, you could potentially obtain components for a fraction of their retail cost. Draft a maximum bid in the meantime and don't wait untillate to check on the auction.

6.Check for AnyDiscounts and Deals

eBay regularly has offers of various kinds, like sitewide sales or coupon codes. Watch for these offers tosave even more on your purchases. Other sellers may provide discounts on bulkorders or for return buyers.

7.Verify Compatibility

Make surethat this component is compatible with your motorcycle beforebuying. Most listings will include compatibility information, but always be sure to cross-reference with your bike's manual or consulta pro if you're unsure.

8.Motorcycle Parts that AreFrequently Seen on eBay

Brake Pads and Rotors: These small but mighty components are key safety items, and frequently discounted priceson eBay.

Tires:Quality tires can be pricey, so eBay always has a nice inventory of cheap replacements from trusted brands.

Lighting and Electrical Components: From LED headlights to turn signals, eBay offers a range of lighting solutions to improve visibility and add style.

All in all, eBay is a goldmine for motorbike lovers hoping to purchase partson a budget. This allows you to find high-quality parts for a fraction of the cost through specific search terms, price comparisons, auctions, and promotions. With the right tools and exceptional resources, you can build the motorcycle of your dreams, without getting burnt by your bank account — on eBay whether you're simply doing routine maintenance, or going all out on that custom build.

Disclaimer:

Disclaimer:

The content provided on our blog site traverses numerous categories, offering readers valuable and practical information. Readers can use the editorial team’s research and data to gain more insights into their topics of interest. However, they are requested not to treat the articles as conclusive. The website team cannot be held responsible for differences in data or inaccuracies found across other platforms. Please also note that the site might also miss out on various schemes and offers available that the readers may find more beneficial than the ones we cover.

Related Websites

-

Travel

TravelWhy Travel Requires Advance Planning and Research

Travel is simply one of the best pleasures of life, an adventure away from home, an island either a break of relaxation or cultural enrichment. But a fulfilling trip does not come about by chance, it does take some planning and research too. Whether wandering a mega city, lazing on a tropic beach or trekking between remote mountains, a little pre-arrival groundwork can help make for smoother, and more enjoyable, travels. -

Finance

FinanceAdvantages of Fixed Income Funds

Fixed income funds have long been an integral part of investment portfolios, particularly due to the diverse range of benefits they provide to both conservative and strategic investors. These funds usually invest in debt securities, including government and corporate bonds and other fixed-income securities, and offer a regular stream of income from their interest payments. Here, we delve more into the benefits of fixed income funds and why they continue to be a favorite among investments seeking stability, diversification, and predictable returns.1.Steady and Predictable IncomeFixed income funds have one of the major advantages that can both generate a consistent and predictable income. Unlike volatile and uncertain investing in equities with progressive returns,fixed income funds pay regular interest. This makes them especially appealing for retirees or investors who need a steady income stream to meet their financial commitments. Returns being predicted make it easier for investors to plan their finances more confidently.2.Less Risky Than Equity FundsUnlike stocks, where the return in volatile, bonds and other debt instruments aretypically less volatile because the return is not directly correlated to the performance to the issuing company. The repayment of bondholders takes priority over dividends to shareholders, even if a company is performing poorly. Government bonds in particular are regarded as a safe haven because of the low chance of default. Such lower risk profile makes fixed income funds a perfect fit for risk-averse investors.3.Portfolio DiversificationFixed income funds are fundamental in diversifying portfolios, one of the principles of prudent investing. Adding fixed income funds toa portfolio can help lower overall risk and volatility. Bonds also tend to have a low or negative correlation with equities so they tend to do well when stock markets underperform. This inverse correlation tends to act as portfolio hedge, offering stability when the market experiences decline, and aiding in long-term prudence.4.Capital PreservationFixed income funds are perfect for the capital preserver investor. If they don't have the earnings potential of equities, they are less likely to lose a lot of money. This is critical for retirees or anyone with financial goals in the near term, as this strategy protects their principal investment from being substantially depleted. Government (particularly U.S. Federal) and other high-qualitycorporate bonds, for example, have traditionally offered a safe haven for capital while still yielding modest returns.5.LiquidityThe liquidity profile in fixed income funds is much higher than single bonds. Although individual bonds can be hard to sell before their maturity date, fixed income funds enable investors to buy and sell shares on any business day. This liquidity offers flexibility, allowing investors to withdraw their funds at a pinch, without facing heavy early withdrawal charges or losses. This facility alsomakes it easier to re-balance portfolios based on changing market scenarios or personal financial requirements.6.Professional ManagementFixed income funds offer professional management, a factor that can be vital in the bond marketlabyrinth. The same goes for flexible debt fund, the fund manager is someone who will analyze credit risk, interest rate cycle and economic conditions, to get the fund's portfolio where it lays out tobe. This professional focus might help avoid bad betsand potentially lead to stronger returns than the same capital would generate if invested in one bond at a time, potentially threatening an individual bond investment.Despite this, fixed income funds provide an attractive balance of consistent income, lower risk, diversification,and capital preservation, making them a necessary part of a diversified investment portfolio. With their stability, professional management and liquidity, they can suit almost any type of investor — stability seekers as well as risk diversification for those with riskier holdings. Not offering as lofty returns as equities, their contributions to dampening portfolio volatility and ensuring financial peace of mind is obvious. However, for conservative investors looking for an asset class that has stood the test of time, fixed income funds have been a tried and true investment vehicle. -

Finance

FinanceChoosing the Best Financial Adviser: A Guide to Securing Your Financial Future

With time going by, one's financial goals become more and more complex, therefore, we need someone professional to help us manage our finance. A financial adviser can help, whether you're planning for retirement, saving for a big purchase or investing for long-term growth. Not every financial adviser is created equal, though. Here's a complete guide to choosing a financial adviser who is best suited to your needs.1.Familiarize Yourself with Your Financial GoalsThe first step toward finding a financial adviser is to clarify your financial goals. Do you want to build wealth, pay down debt, or save for retirement or your child's college education? Different advisers will have different specialities, so if you're clear on what you want to achieve this will help you think about what types of people you might need. If retirement planning is your priority, you will want an adviser who specializes in pension plans and long range investing strategies.2.Verify Credentials and ExperienceThe credentials a financial adviser has and how many years of experience they have in the business are important markers of expertise. Seek certifications such as CERTIFIED FINANCIAL PLANNER (CFP), Chartered Financial Analyst (CFAs), or Certified Public Accountant (CPAs); These designations require substantial training, and there are professional standards behind them, but no bar exam or certification as there is in law. Also, ask how long the adviser has been in the industry. The healthier the body, the more capable you are of developing muscle, realizing that your new actions and the fat burning process soon are the results of habit and time.3.Evaluate Their Fiduciary DutyA fiduciary, by law, is required to act in your best interest — putting your needs ahead of their own. That means they put your best financial interest ahead of the commissions or fees they might earn. Always ask if the adviser is a fiduciary and, if necessary, ask for written confirmation.4.Get a Grip on Their Fee StructureFinancial advisers may be compensated in a number of ways, but the most common are fees, commissions or a mix of the two. Flat-fee, hourly or percentage of assets under management fee-only advisers may be less prone to conflicts of interest. Commission-based advisers earn their money from selling financial products, and their sales may not be in your best interests. Ask about their fee structure upfront and make sure that it's clear and reasonable.5.Check out Their Communication StyleGood communication is paramount to a successful adviser-client relationship. Your adviser should be able to distill complex financial concepts in an understandable way. They should also be available and responsive to your questions and concerns. In those initial meetings, look at whether they listen well and if they personalize advice to your particular circumstances.6.Check out Reviews and Ask for ReferencesWhen choosing a financial adviser, reputation matters. View the online comments or testimonials, or ask for references and suggestions from previous clients. This can help you judge whether they are reliable and professional. Don't be shy about requesting case studies or other examples of how the adviser has worked with clients with similar financial goals.7.Trust Your InstinctsFinally, listen to your gut feeling. Choosing a financial advisor that meets your standard and makes you satisfied is very important, because he or she determines how your financial conditions operate. If something doesn't feel right with your experience it's just fine to continue looking until you meet people who you connect with.In short, hiring a financial adviser may be one of the most important decisions you ever make in the course of managing your finances successfully. Knowing your goals, researching credentials, verifying fiduciary duty and testing communication styles will help you find an adviser that aligns with your needs and values. Take your time, ask a lot of questions and remember that the right adviser will do more than help you manage your money, they will empower you to reach your full potential financially.

Featured Articles

-

Finance

FinanceWhat to Consider When Opening an Online Bank Account

-

Home & Garden

Home & GardenDifferent Window Blinds for Different Rooms in Your Home

-

Automotive

AutomotiveWhy Choose SpeeDee Oil for Your Vehicle?

-

Health & Wellness

Health & WellnessUnpleasant Effects of Chronic Hives

-

Health & Wellness

Health & WellnessWhy Do I Fart So Much? Understanding Excessive Flatulence

-

Health & Wellness

Health & WellnessEtiology of Hives

-

Home & Garden

Home & GardenChoosing the Proper Furniture for Your RV

-

Travel

TravelLast-Minute Vacations at the Best Prices